Over the last quarter, SIZE has talked to a lot of treasuries. TLDR; there isn’t much treasury management. There is no metagame. There is no framework. There are just treasuries and DAOs trying to play trader. Either the price is too low or it’s about to moon. And while treasuries try to TA, runrate keeps running.

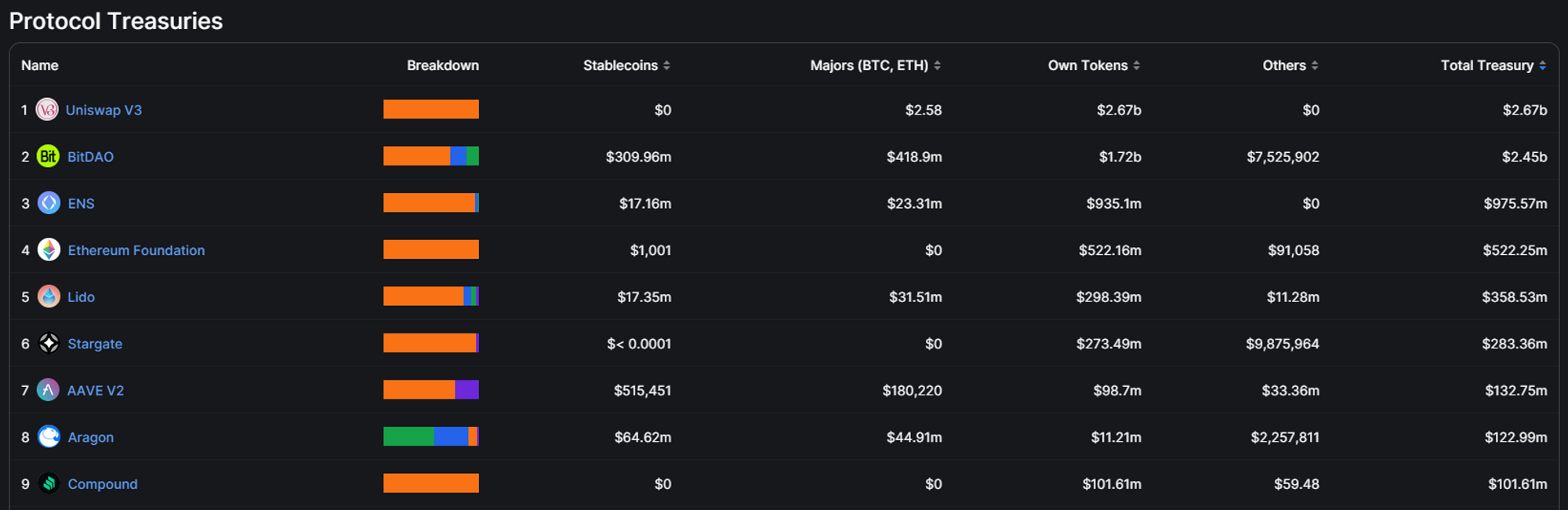

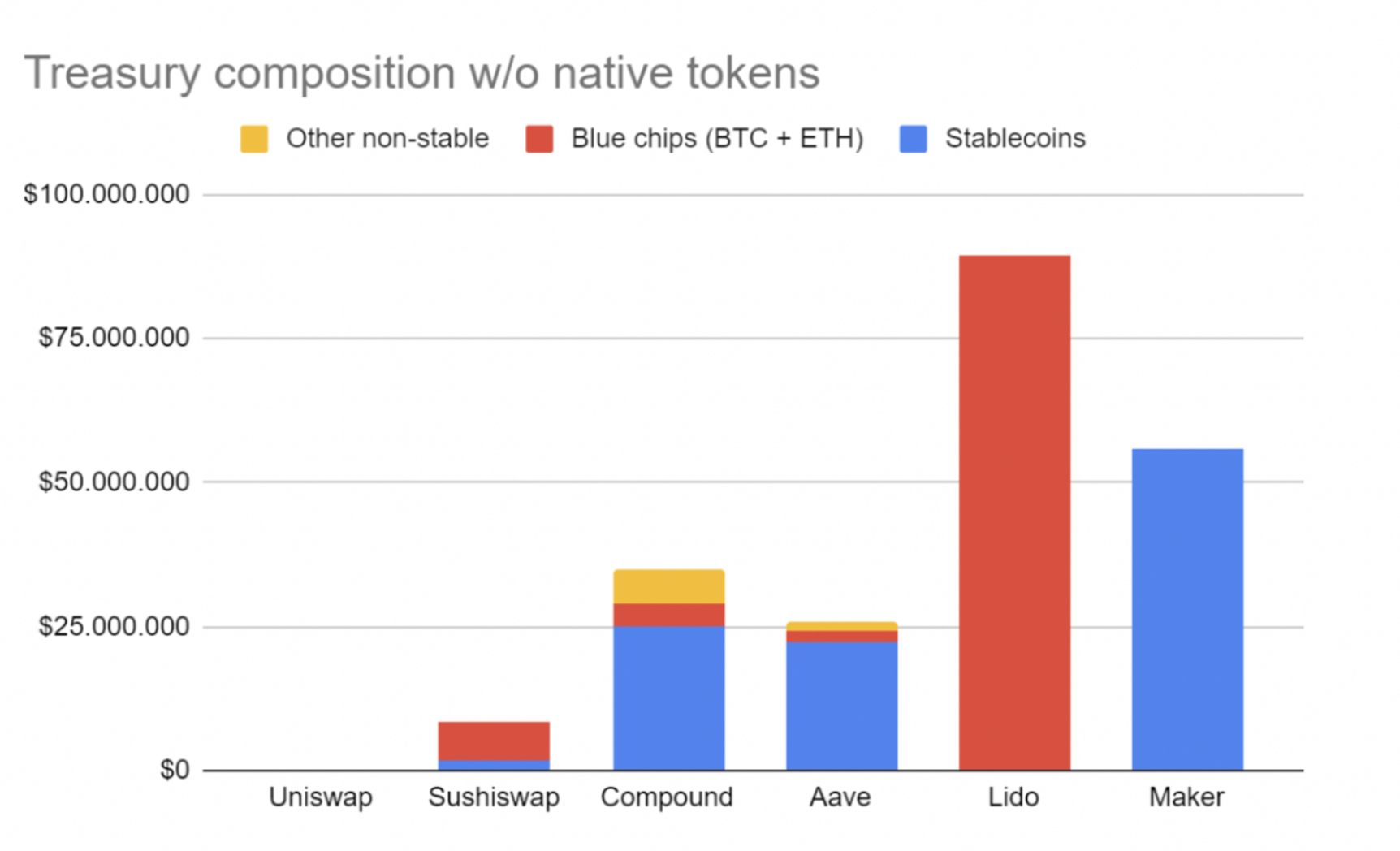

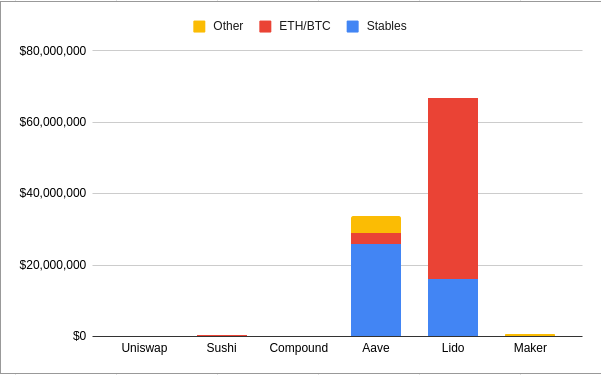

Below is a breakdown of holdings from the top treasury protocols. Orange shows the portion of treasury in the protocol’s native token. Discounting native token allocation, a large majority of treasuries wouldn’t have funds.

One thought, which we outline in this blog, is striking—

Top treasuries have billions of dollars, but very little asset diversification.

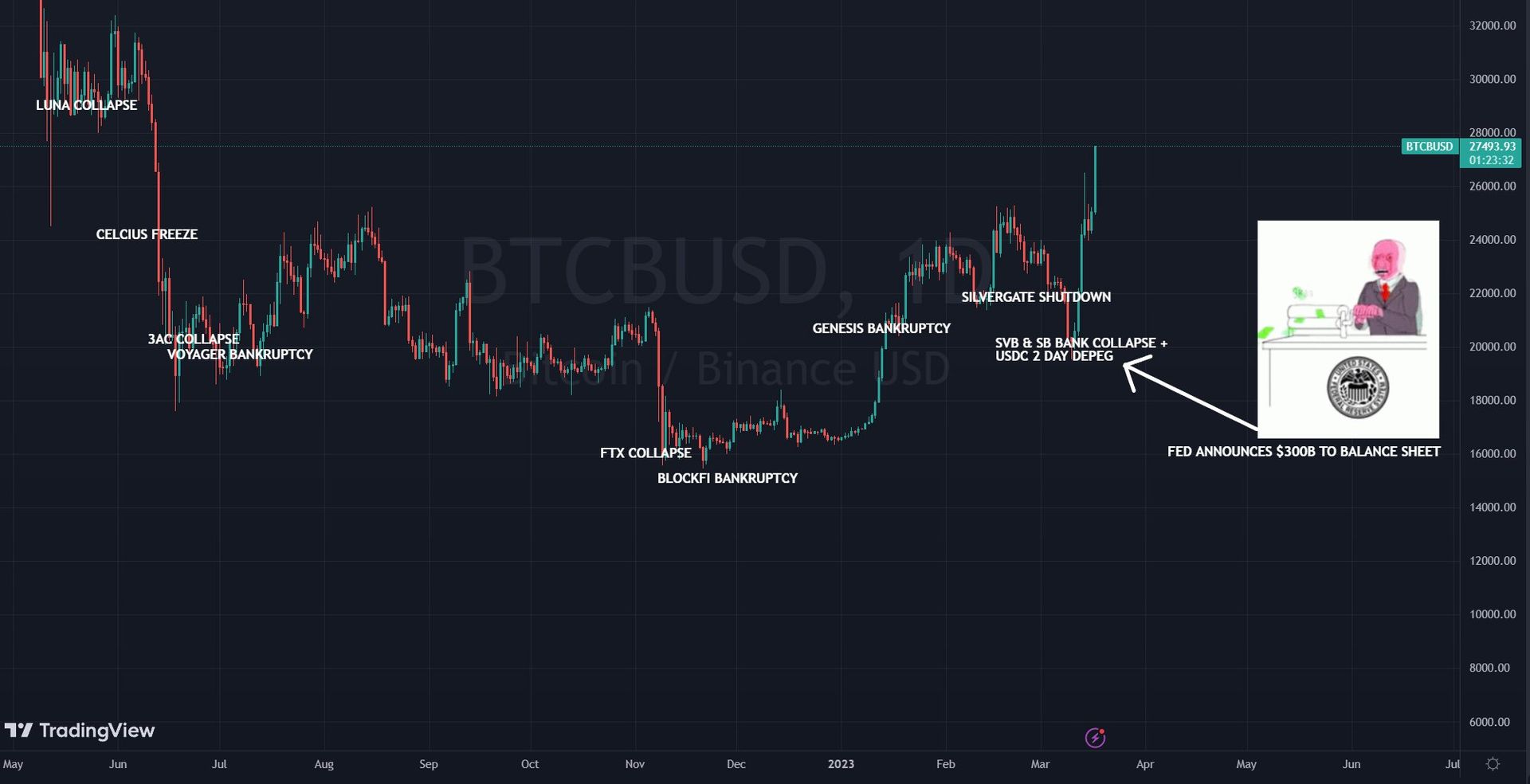

Treasuries are Vulnerable to Markets

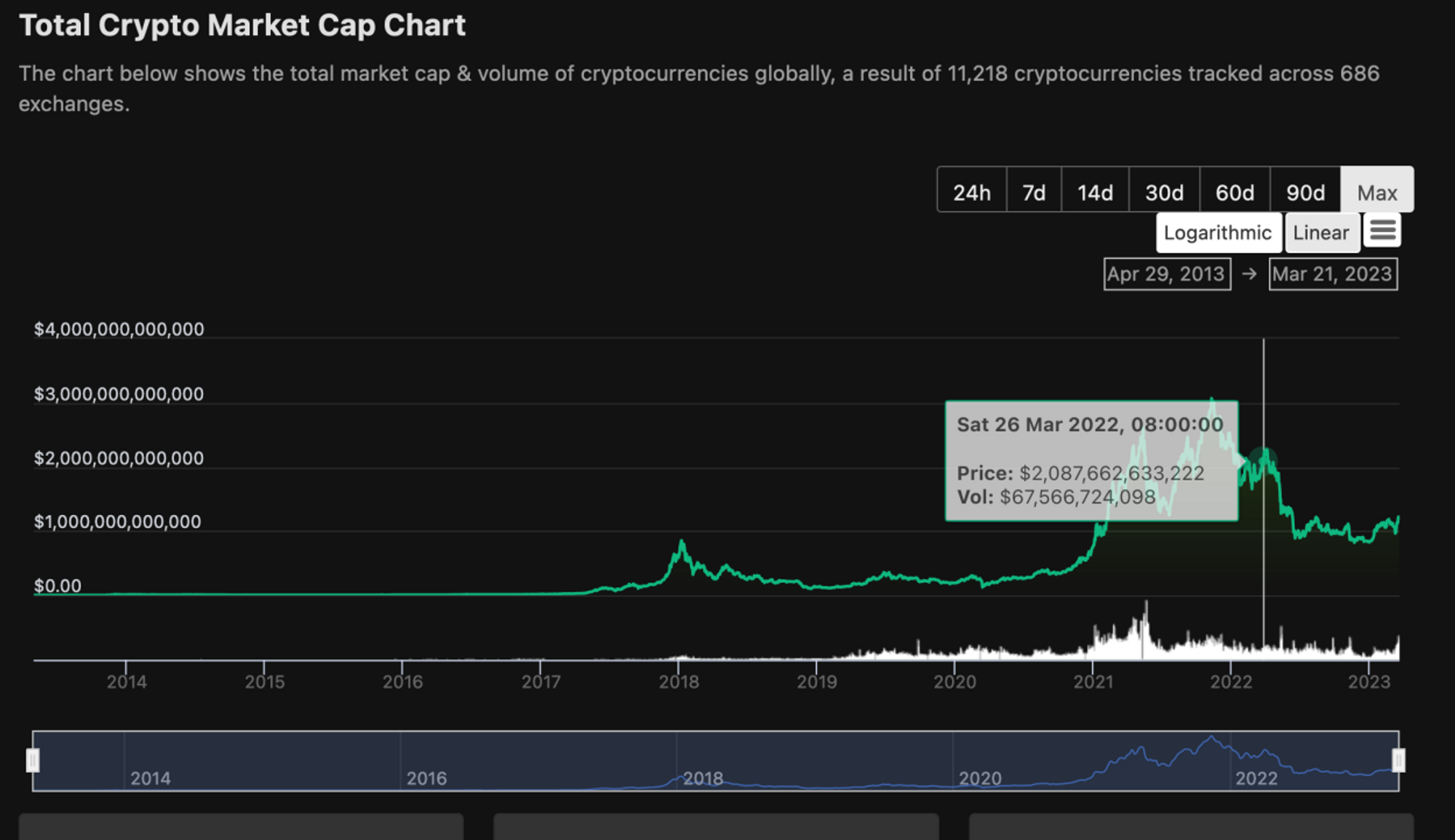

Today, the total treasury market cap is ~$13.5 Billion dollars with ~80% of that comprised of liquid tokens. Treasuries have seen large swings due to economic conditions, % liquid tokens, and lack of asset diversification.

Over the last week alone, we have seen a 10% bump with a $1.7 Billion dollar increase in treasury market cap. We love a good bump. But for every bump, we’ve seen a dip. During this bear market, the total crypto market cap dropped around ~$2 TRILLION dollars.

In the last 24 hours alone, Uniswap’s treasury cap dropped by -%5, DYDX saw an -8% dip, LDO saw a -7% dip, Aave & SNX saw -4% dip. That’s a big swing overnight.

Let’s zoom out and look at some of these projects in-depth

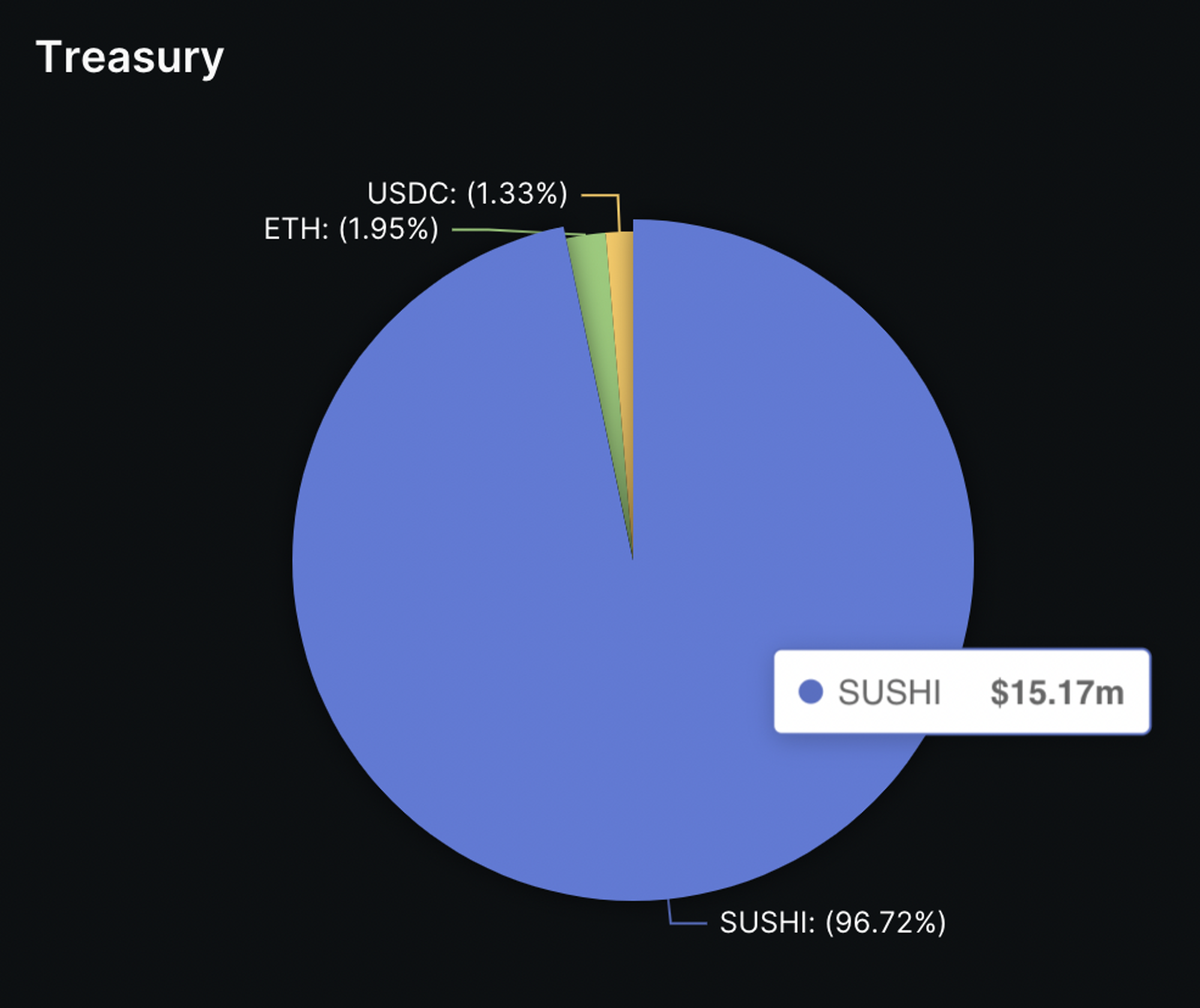

Sushi which has a treasury of $15 Million holds 97% SUSHI.

Over the last year, the price of SUSHI dropped by 75% which unsurprisingly impacted treasury market cap substantially.

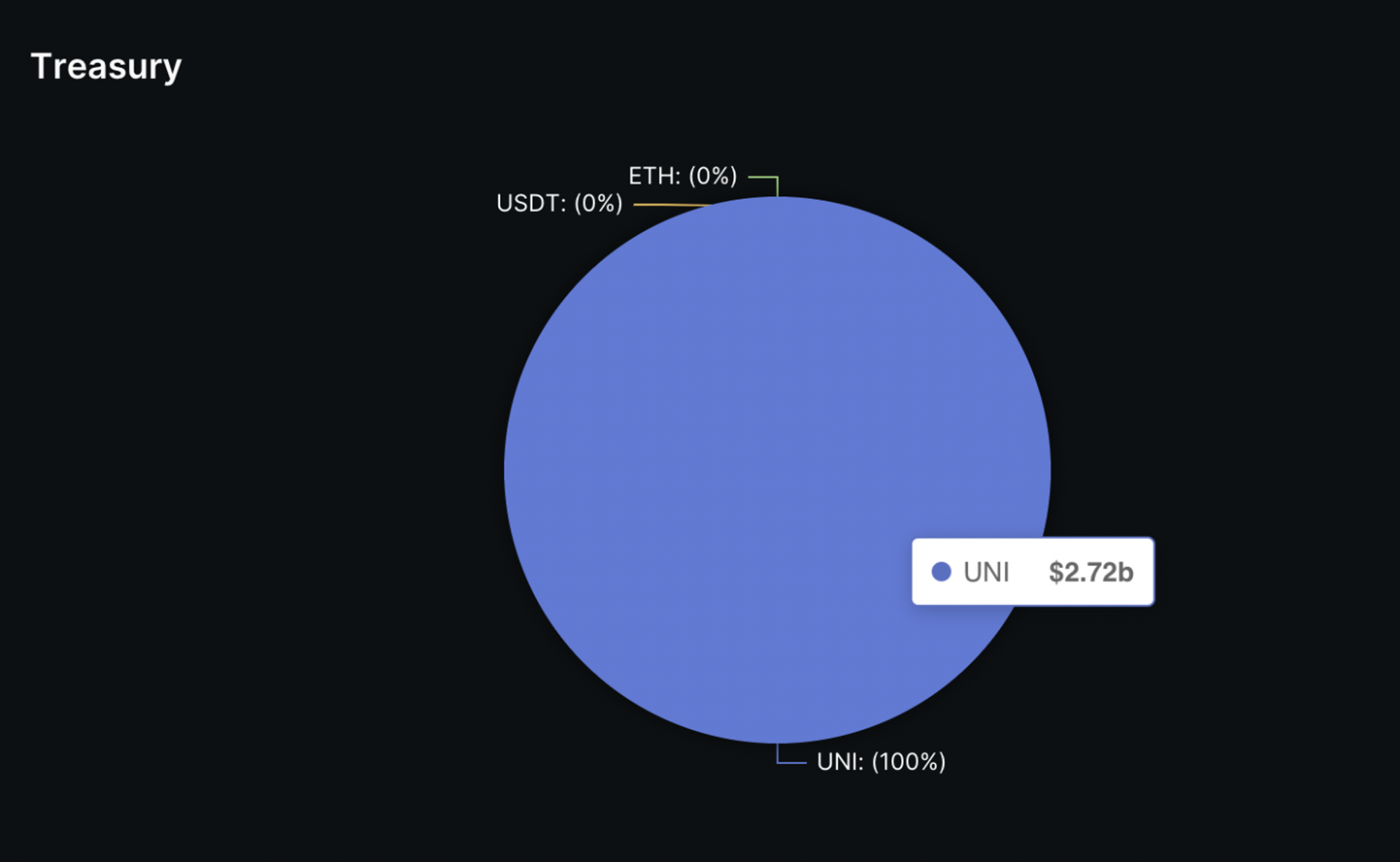

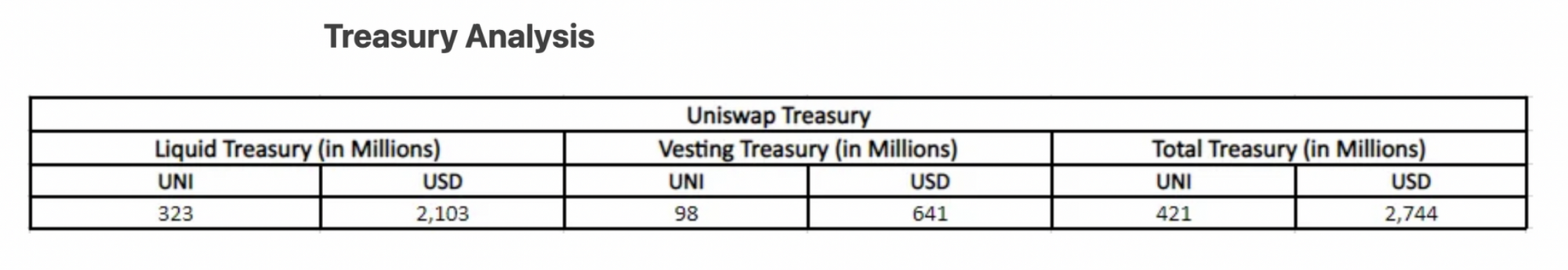

Uniswap has a treasury of $2.7 Billion is 100% UNI.

Over the last year, UNI dropped ~50%.

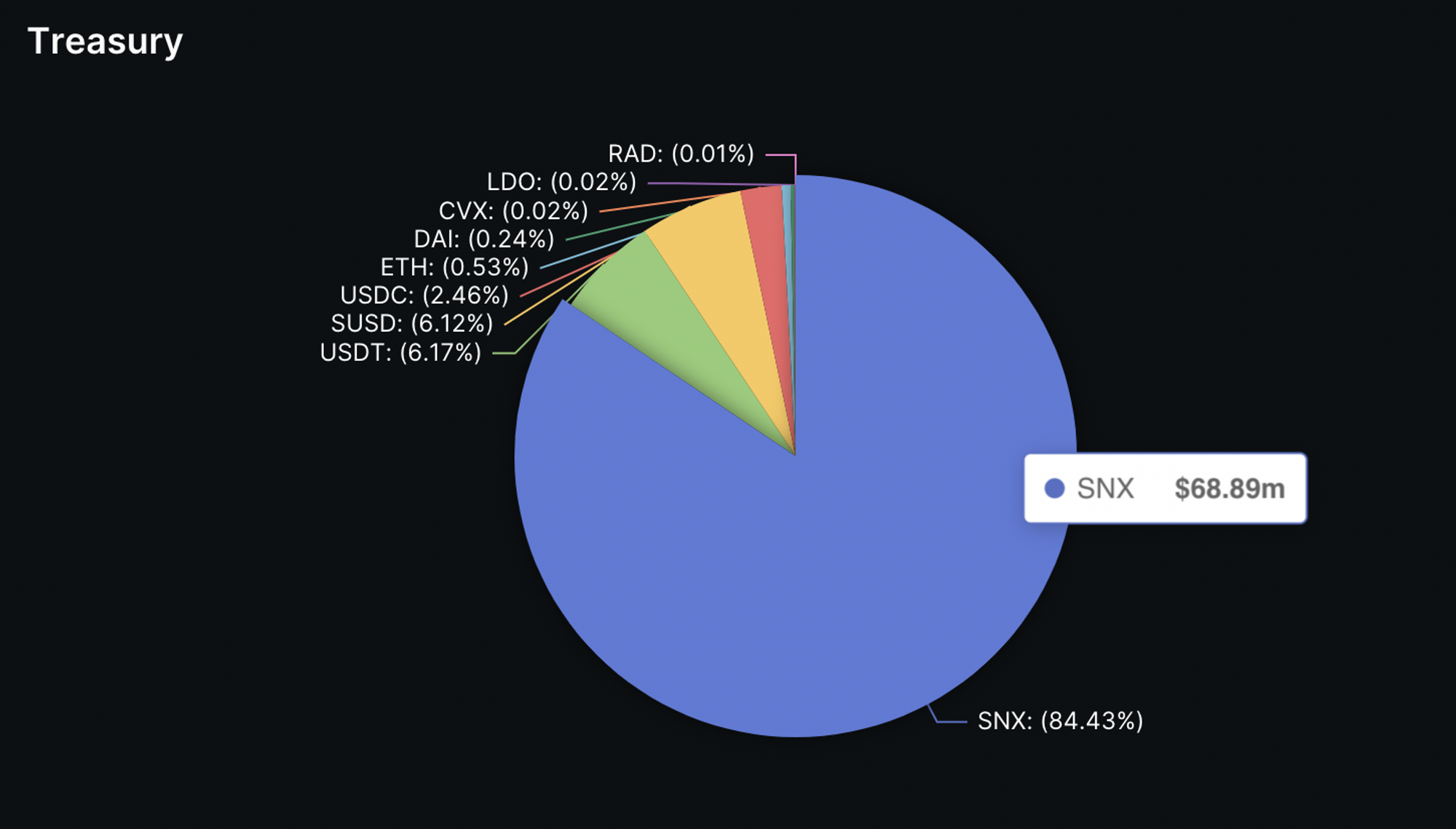

SNX’s treasury is worth $87 Million with >80% of that in SNX.

SNX dropped ~70% over the last year. 1) What

Frog in Boiling Water

"DAO treasuries need to survive the next bear market. It might not happen next week or next month, maybe not even next year…but it will happen."

Let’s be clear. Lack of treasury management and swings in treasury market cap isn’t a recent revelation. Hasu wrote a blog on this in 2021, using March 2020’s black Thursday as an anchoring event to emphasize the importance of tackling treasury management before another bear market. Two years later: another bear market, more black swan events, same story.

- Treasuries are not diversified.

- The same blue chip protocols from 2020 (UNI, AAVE, LDO, COMP) aren’t diversified.

- Native tokens are viewed as assets on balance sheets when they shouldn’t.

- Treasuries practice reactive treasury management which results in price impact.

- Treasuries barely cover runrate let alone application specific liabilities.

Treasury Breakdowns

Despite headwinds, some protocols have made progress. Let’s take a look at some of the teams that diversified. Specific strategies aside, they have the benefit of not panicking when stuff hits the fan. Which it does in crypto. Often.

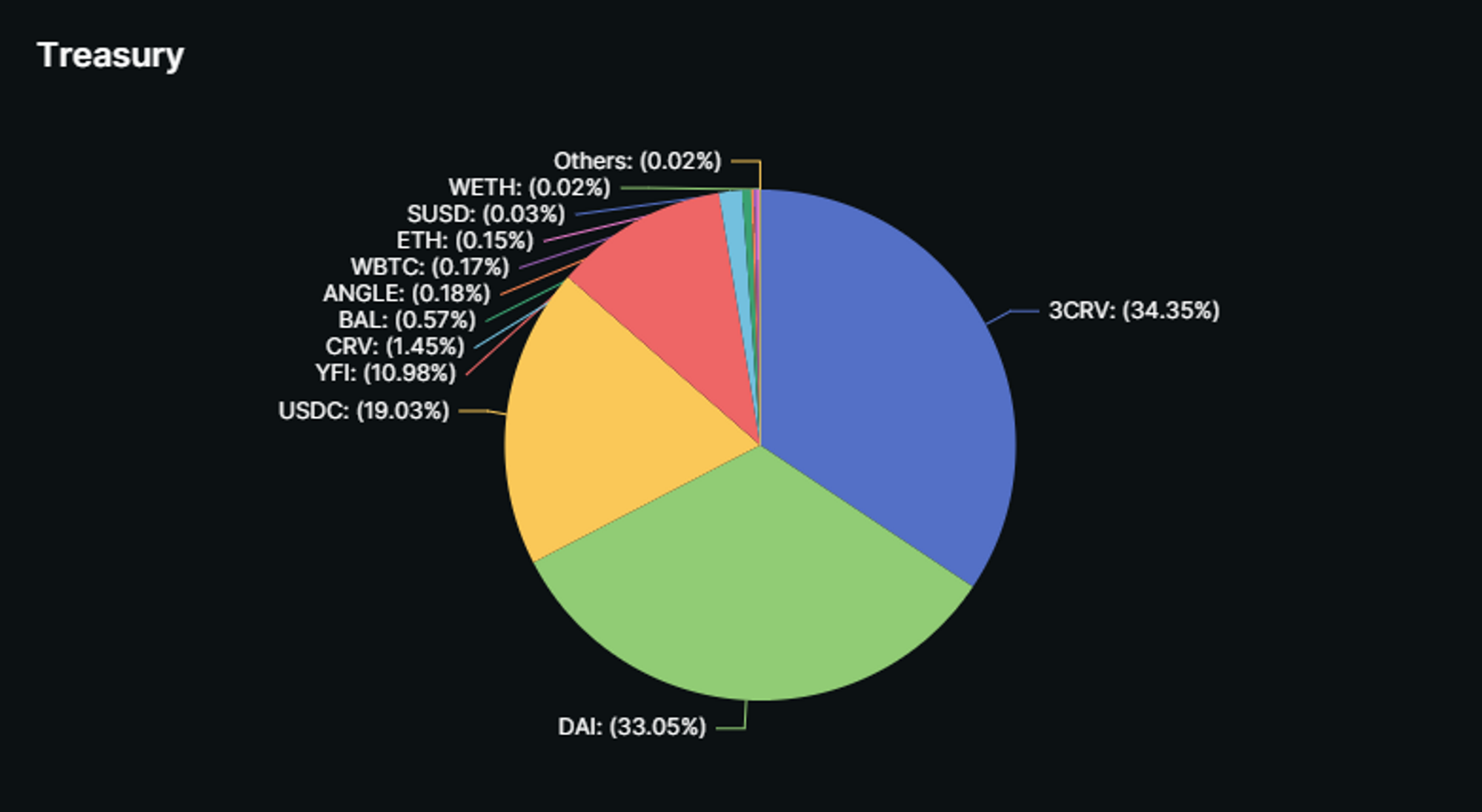

YFI

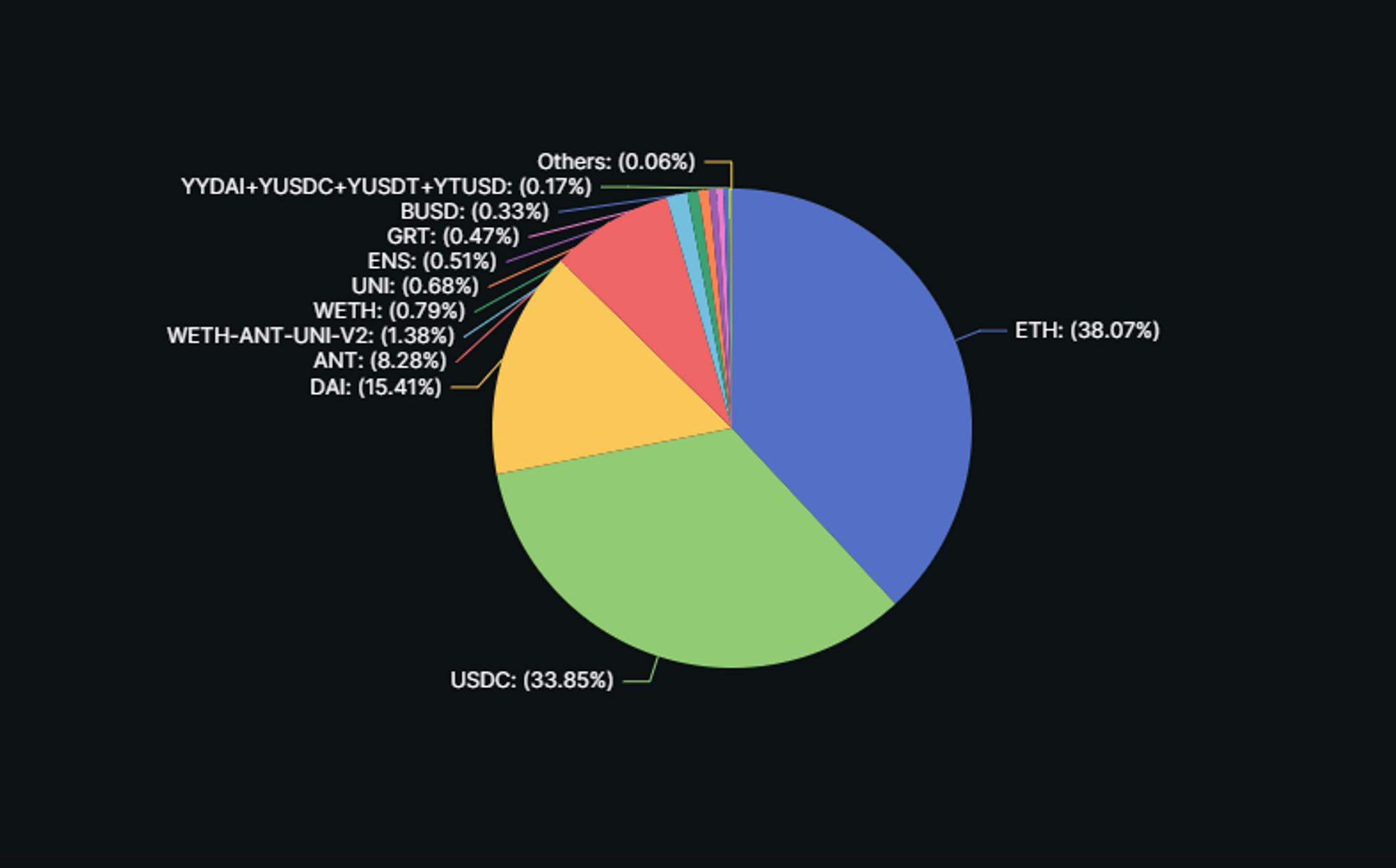

Aragon

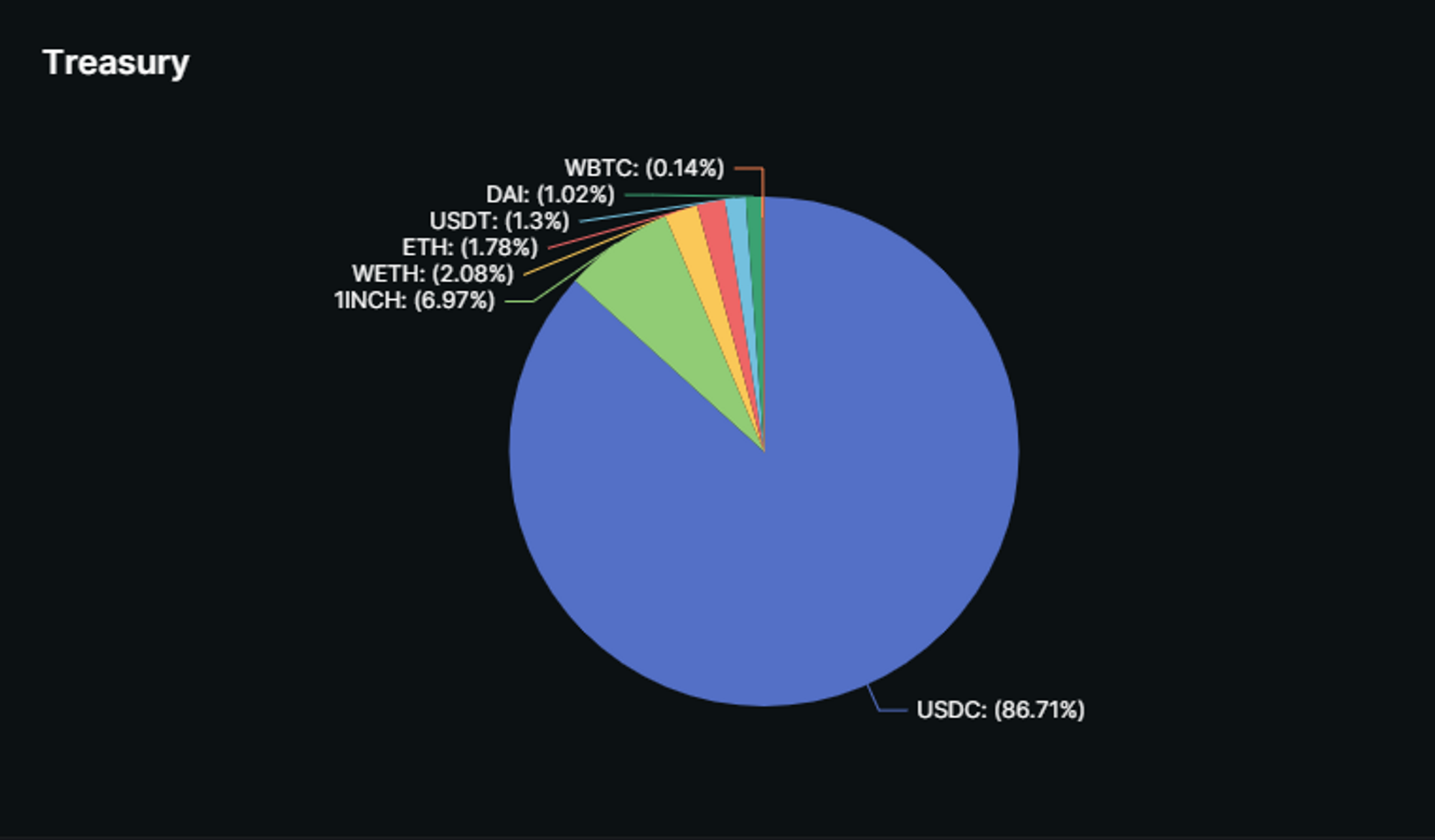

1INCH

These are a few treasuries have decently diversified and are well-positioned for building over the next several years. But that leaves many more treasuries to go. Some protocols have monthly financing reports which is another step forward but they are either too dense or too slim.

Proactive and responsible treasury management means creating a divestment strategy.

Treasuries require discipline to make decisions for the long-term that support their ecosystems. Estimating 18-24 months of runway for these protocols in terms of salary, yearly expenses, with an additional cushion is the responsible practice.

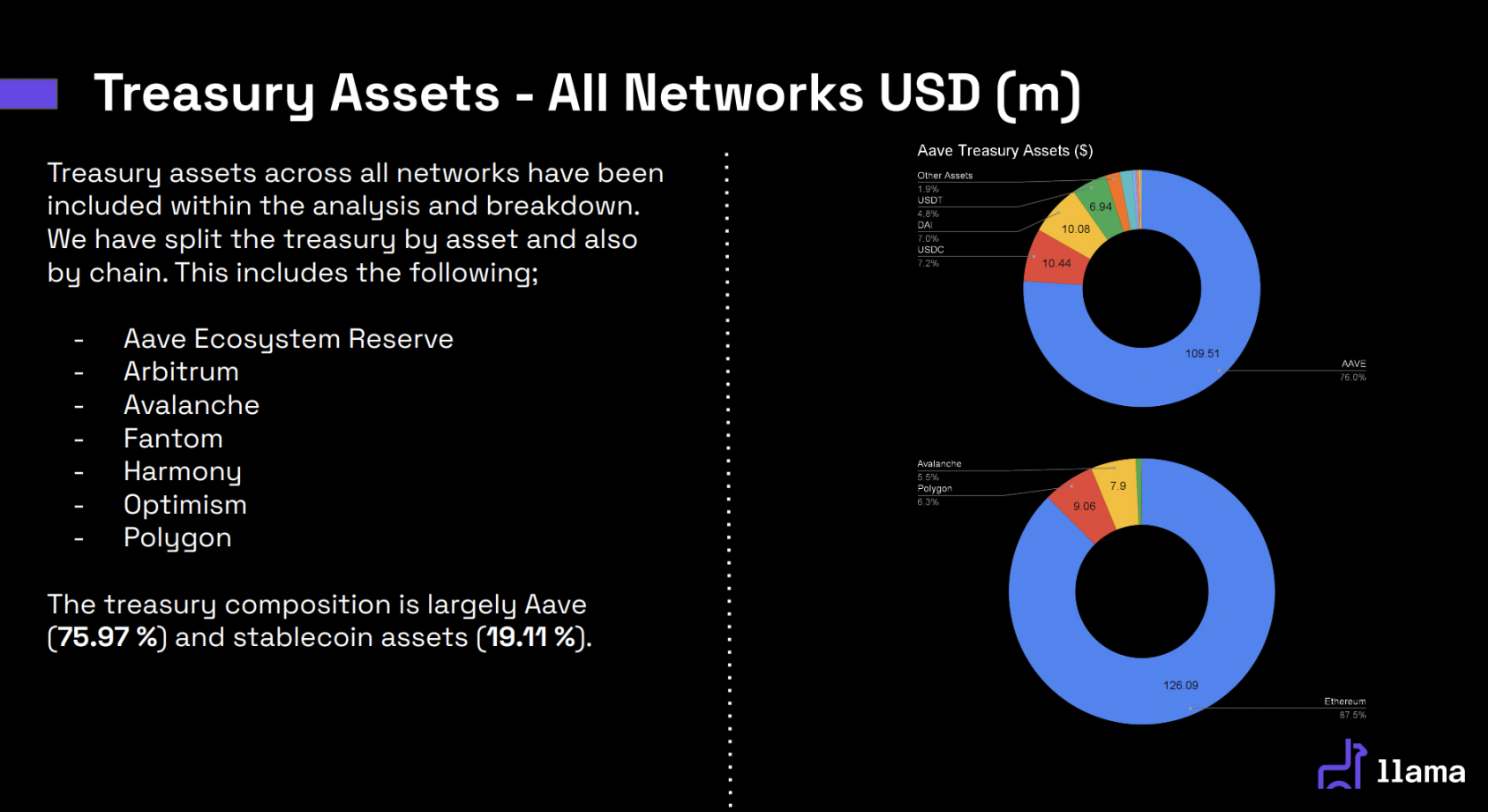

Snapshot from an Aave February financial report:

Snapshot from an UNI January financial report:

Ideally treasury management and overall protocol financing should be managed together so that there is a clear economic picture.

Stop Trying to Be Right, Start Trying to Be Viable

With 2020 still near in the rearview mirror and the recent USDC calamity, people with their assets in crypto have no choice but to find ways to diversify risk. That scales to the treasuries of protocols whose tokens they own.

How can we expect protocols tasked with creating the future of finance to operate responsibly when they can’t guarantee paying employees through the year?

Below we’ve got a quick snapshot of treasury balances when you discount native tokens. It unironically looks almost worse than the 2021 snapshot. Disclaimer: it took some sifting to find these wallets. Just another point that treasuries are obfuscated.

2021 treasury balances when you discount native token

2023 treasury balances when you discount native tokens

Stables aren’t much better.

Silvergate, Signature, Silicon Valley Bank. And now Credit Suisse and First Republic. Hundreds of billions of dollars that for all intents and purposes should’ve been secured and seen as safe disappeared overnight. “Money in the bank” no longer means what it’s supposed to.

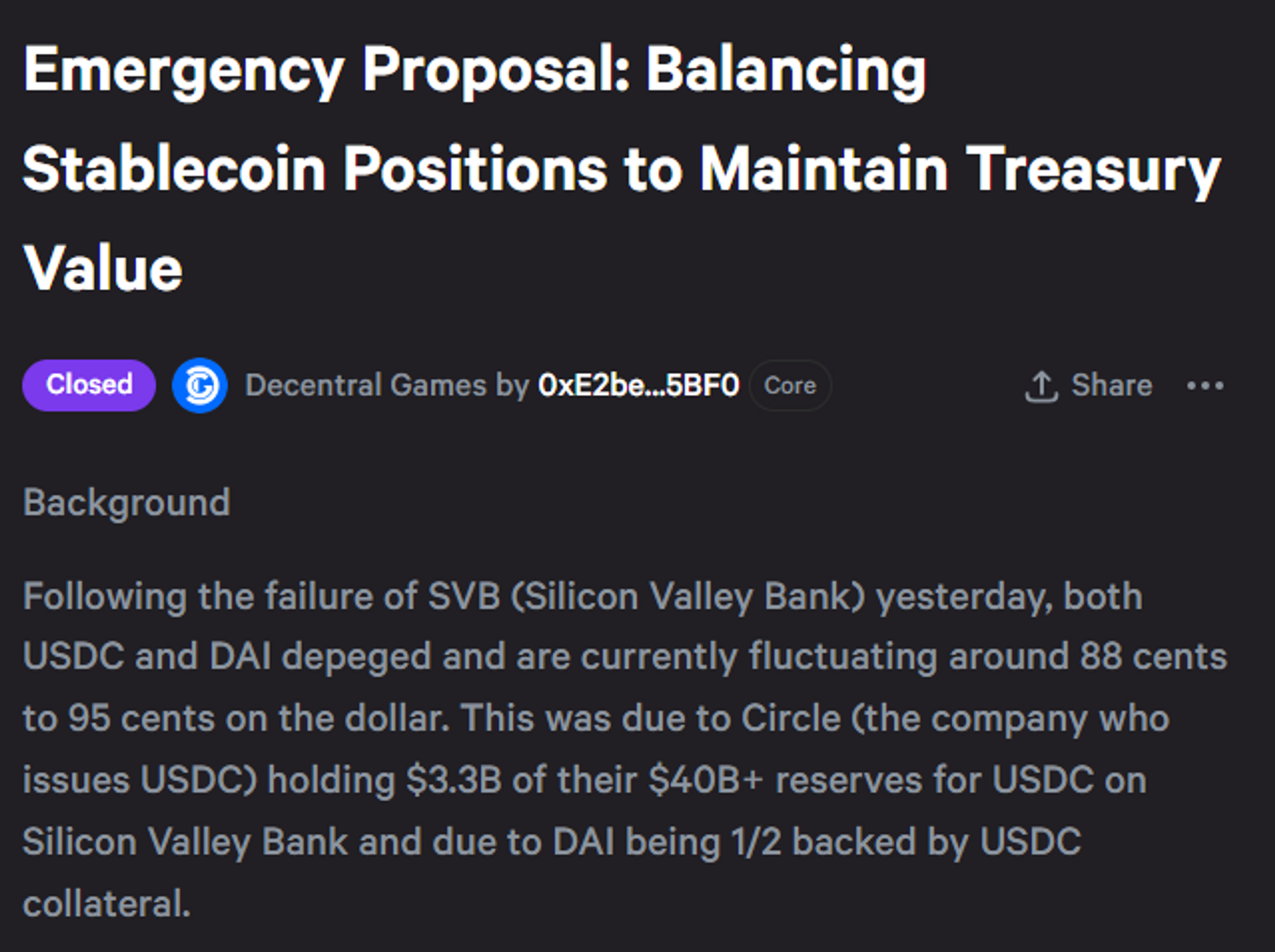

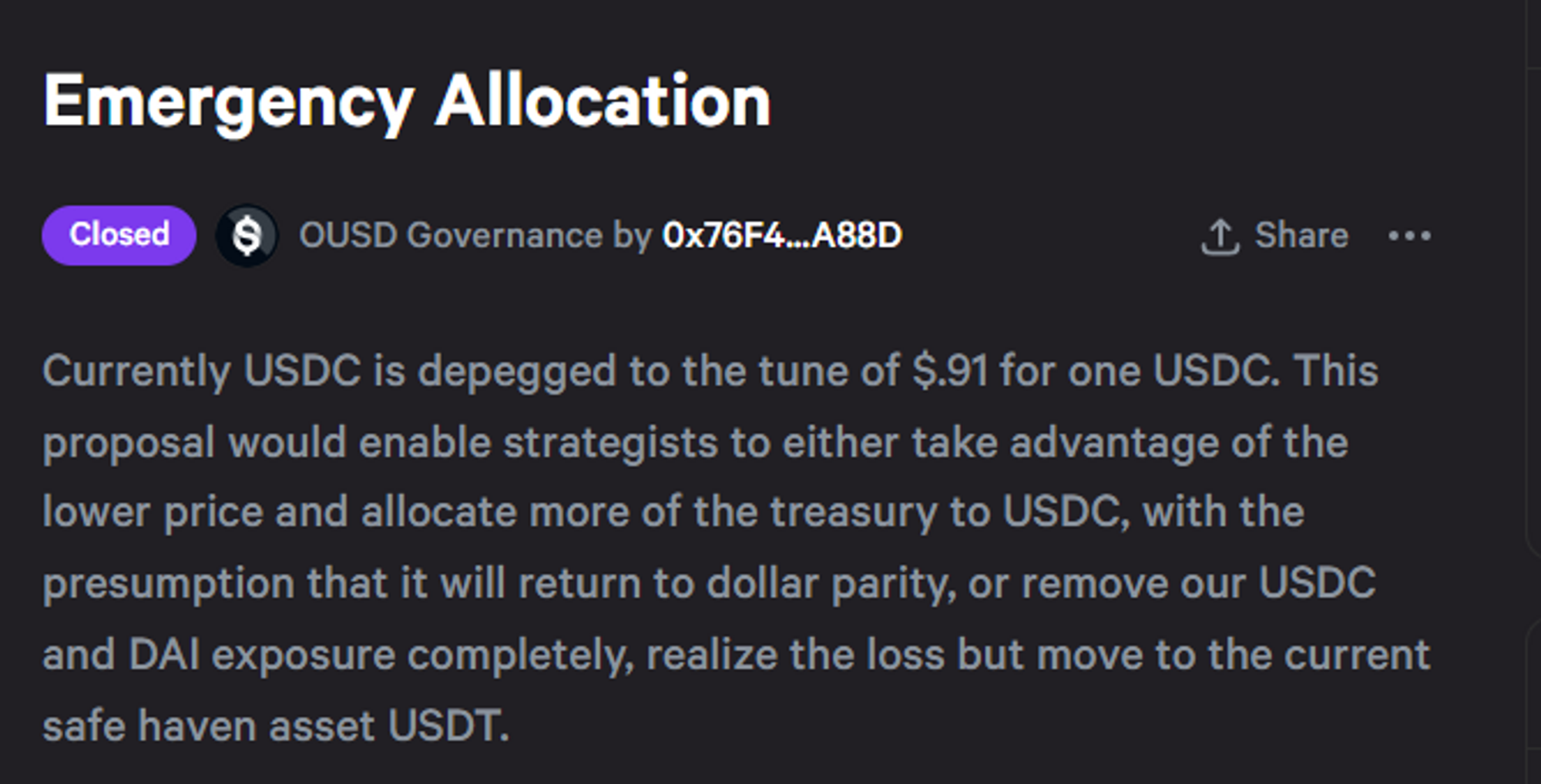

Circle, a behemoth in the industry, had USDC depeg over 12% amidst fears of illiquidity.

Rumors flew and as a result many who thought they were safe in stables saw their networths fluctuate in ways they never expected. This might be fine for professional traders, but not for protocols.

More recently, after the SVB announcement and amidst the USDC depeg, token prices and treasuries fell into a freefall. SNX, Uniswap dropped between 15-20%.

Treasury management is a topic during market crashes but seems to recede into the background after the dust settles. It’s probably historically been overlooked because the reality is that it isn’t sexy, it is difficult to corral DAOs into consensus, and money has by and large not been a problem in crypto. But if the bear market has reinforced anything, it’s that this is irresponsible behavior.

The life blood of these protocols shouldn’t be subject to the ups and downs of the market. If DAOs want the expectation of lasting several market cycles, they should proactively diversify in ways that support their long-term plans.

Think Before You Act

Currently, a lot of decisions are reactive to markets or market driven events.

Governance forums are already a shitshow where consensus goes to die. Tooling is crummy, there are too many threads, too many sites, different voting mechanisms. Final hour, reactive, treasury proposals don’t have a lot of hope. And it isn’t practical for protocols to expect communities to engage thoughtfully to reactive or time-sensitive treasury governance proposals.

There should be proactive, agreed-upon, clear, reliable and recurring strategies.

Without a clear economic picture or strategy for managing risk, protocols are hostage to economic riptides. Over SVB weekend, a lot of treasuries had to act rashly during the USDC depeg, either panicked they’d lose all their value or worried about fleeing from generally weak to stronger assets.

Some of those governance posts:

This isn't a judgement, but rather to highlight that there’s no clear framework when it comes to diversification. The top token treasuries should set a precedent here— diversifying the most after having weathered the harshest bear markets. But it doesn’t matter how big your treasury is, what matters is how you use your tokens.

Maybe there’s a hesitation from DAOs around diversification because of lack of knowledge. Or maybe the evergreen issue of coordinating the community to vote. But if anything, SVB should be another wakeup call to anyone with a vested interest in crypto.

“But We’re Betting on Ourselves!”

To be clear, this isn’t recommending trading with the treasury. No one wants to be the next Substratum, using their treasury to short ETH at $80. But treasuries should always be willing to sell some of their assets at a locked discount to cover run rate.

Treasuries have varying concerns when it comes to perceived risk of their assets.

Some have legal or tax concerns. But most of those come out of uncertainty or a lack of knowledge rather than a confirmation of wrongdoing. Treasury diversification is seemingly no different than LPing on a DEX, or topping off LDO reward accounts to LPs. For all intents and purposes, it’s an extended trade.

There might be an initial fear in sold tokens getting dumped, but a recurring sell of locked tokens at a discount prevents this while also finding fundamentally aligned investors. Setting the precedent and cadence for a strategy like the above allows protocols to hedge responsibly while also bringing the community along in a transparent and thoughtful way. SNX’s recent $15M treasury OTC surprised the community and led to community confusion and discord flurry. Aligning and bringing along community is key. Crypto is already chaotic enough.

There’s a better way.

Where Does That Leave Us?

No more gambling. This is why CEOs and DAOs should stop playing TA trader and hire CIOs instead.

While it might change from protocol to protocol, there are fundamentals that are table stakes for everyone. These include at a minimum:

- Clear ownership within the DAO on who the points-of-action are for the community. Whether a council or person, leaving it up to the community ad hoc means it will not get done.

- This includes agreement to prioritize and delegate to that group or person. There is nothing worse than arguing at the one yard line over who is carrying the ball.

- Proactive treasury management that runs consistently, not subject to market whims.

- For example, a 75/25 allocation— 18 month runrate in stables across the top 3 stables.

- An agreement to DCA monthly or quarterly into those stables.

- A pre-approved group of protocols to execute sells.

- Clear metrics tracking treasury management to give the community transparency at any given time.

There’s a lot of work treasuries need to do, but they can start with the basics.

Call To Action

OG DeFi protocols need to lead the way here. Looking at teams like AAVE, UNI, SUSHI and SNX.

Recent events have highlighted the need for diversification— and not just “blue chips.” Even stablecoins have proven to not be stable. Ironically, laying risk off in smaller, well-established coins could also make sense.

No one knows what the future holds and the best bet might be a few different bets. With this in mind, treasury diversification can help some protocols stay around long enough to actually use the money they have.