In the 1800s, it was illegal to propose to a woman and not follow through on it.

It’s true. Society felt a woman relied so much on a man’s proposal that when it fell through, she was able to seek damages in court. There’s a foundational belief that volunteering your help puts you on the hook. You’re only as good as your word.

Unfortunately, that duty has become a thing of the past.

Now, people don’t want wives. They can get 2D wives.

Now, people want DAO money.

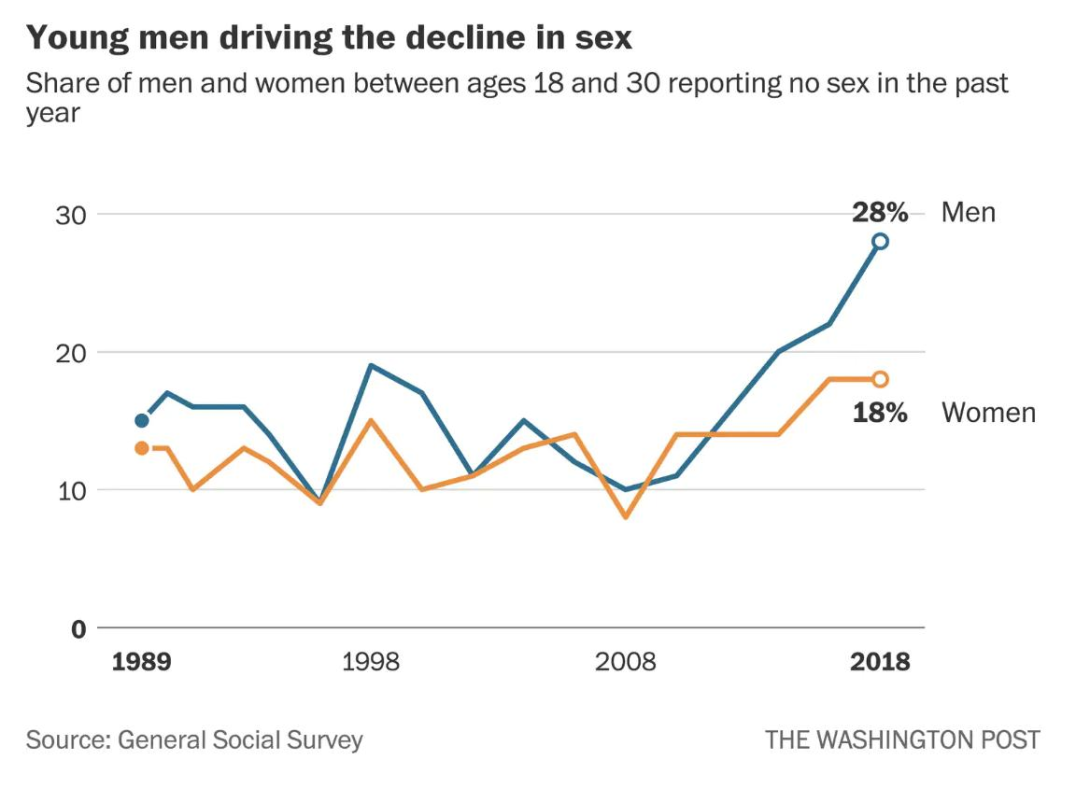

DAOs control a ton of money. Treasuries control $24.1 Billion. Who controls that money? Theoretically large swaths of communities, right? Well, there are 6.9M active governance token holders. This sounds like a lot. However, in reality, only 30% (2M) of those people are actually active. Realistically much lower when you take into account multiple wallets etc. “Legitimate” activity is highly skewed as well — only 2% treasuries have more than 100 members.

We’ve been deep in the DAO trenches over the last months. It’s been eye opening. There’s a lot of good, a lot of bad, and a lot of work to be done. We believe that the main issue with DAOs is the underlying infrastructure. TLDR: There is none. It’s difficult to access, engage, remain active, stay up to date. DAO infra is either absent or fragmented. Without clear, easy, and frictionless end-to-end infra, DAOs will never get the participation needed to become truly decentralized. Without stable participation, DAOs will remain vulnerable to manipulation, abuse, and attacks.

A mix of being early — unpolished UX and lack of engagement — have created pain points that we’ll sum up in four areas, easily remembered with LARP.

Liquidity

Access

Readability

Process

Process

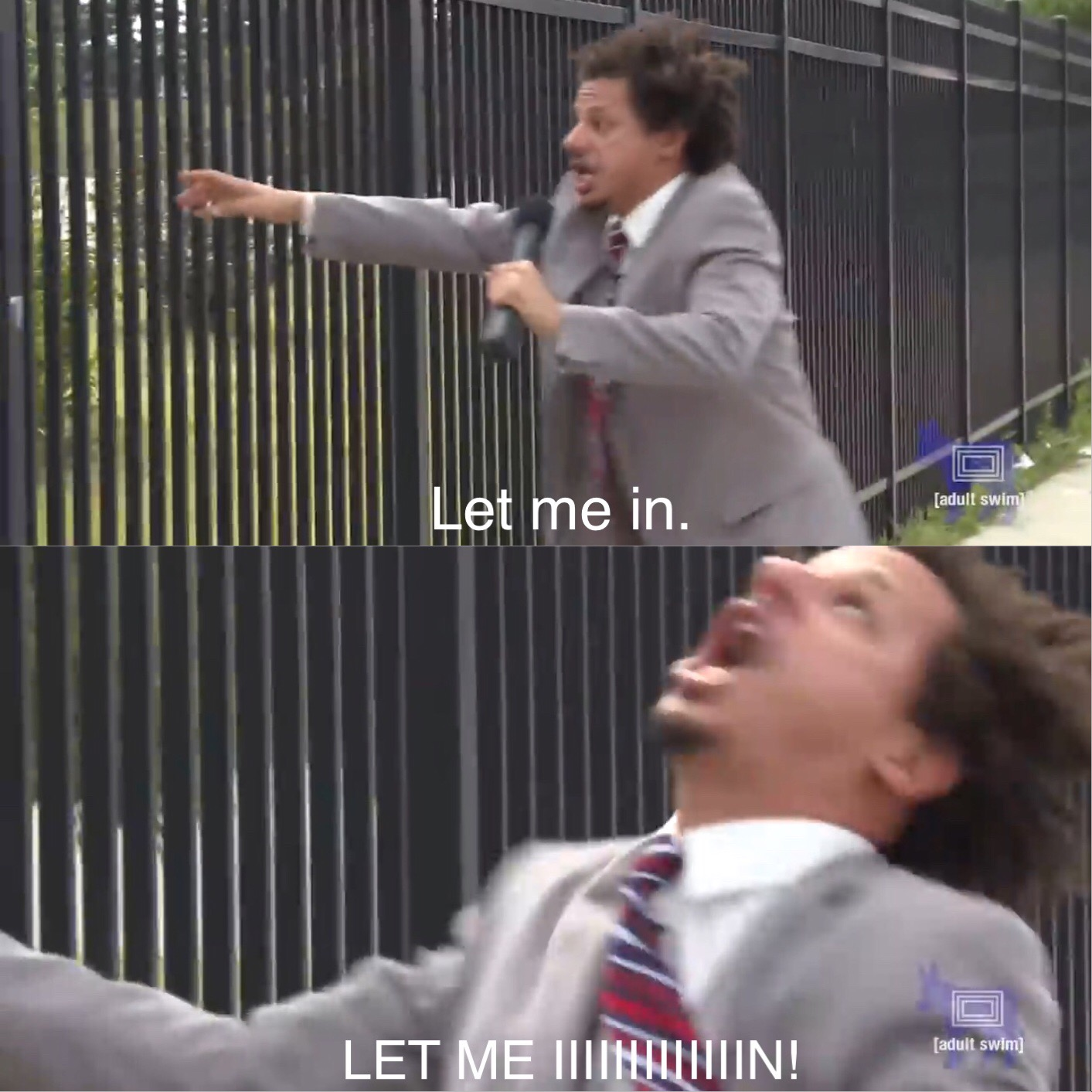

Participating in DAOs is hard.

Let’s start with a simple question: How would you vote in a DAO?

No, really.

Most people would probably Google “[token] DAO” and hope they click the right link, or maybe go to the token’s site and look for the governance section, although realistically teams would rather hype their selling points than their governance board.

Even just registering accounts can be nearly impossible.

Some protocols require approval to make the account, others require approval to post. Some require tokens. Don’t get us started on voting power. One protocol, that won’t be named, had a governance intern asleep at the wheel and forgot to approve new accounts on its protocol for a few days. That intern was confirmed chewed out.

On that note, there’s no consistency between boards. Some have a board to post, others require Discord accounts and keep the conversation there, some just go straight to Snapshot. There are various levels of no to extensive conversation before proposing a topic and even then, there’s little incentive to participate.

A recent blog about DAOs highlighted this written by an anonymous group aimed at extracting DAO money. Most of the actors participating in the governance process want something, usually enough votes on their own posts. This group had instilled several shills within the ecosystems, and sometimes the teams themselves, and have been quite successful.

They point out how few people even want to engage in DAO governance— no one wants to do the busy work in the group project— especially when you’re not even likely to get engagement.

Readability

Understanding what’s going on in the DAOs is not easy.

There’s an argument for not participating if you don’t know what’s going on. Don’t touch the wheel if you can’t drive. But if protocols want their tokens to be so widely available — want to truly democratize finance — that includes making participation digestible, not just splintered.

A lot of this is a UX problem. It’s hard to find a path to the right forum, much less the right thread. There’s often no uniformity in posts, so whoever can sound the most professional will generally get agreement. Sometimes the forums are impossible to understand, or wade through, which disincentivizes users from participating. Bots clutter forums as well which compound the readability issue.

Not every poster should be Ernest Hemingway, but the readability of most of these threads is lacking. Either too technical or not technical enough, shilling stats while ignoring necessity or vice versa.

Access

You’ve figured out the process, you’ve even figured out the forum.

Now you want to participate.

Unfortunately, that’s not always easy either.

Some DAOs require holding tokens to participate, protocols like STG require a minimal amount of veSTG which actually makes sense. Have skin in the game. But other protocols require a baseline of thousands of dollars to play. There’s one protocol whose baseline is so high, only five wallets can vote.

There’s sometimes no access. One protocol simply had no space for governance beyond adding shitcoins for yield. They evidently weren’t taking suggestions.

Other forums allow any proposal because the line to move to an actual vote is so high– a minimum level of engagement that’s more than total engagement on the forum. Nonsensical thresholds like this make participation an M.C. Escher maze.

Liquidity

No one wants number to go down.

Treasuries are hesitant to sell tokens, even at the risk of total bankruptcy. They’d rather hold than sell.

As mentioned in the last blog, this had led to a trend among treasuries of keeping their holdings almost entirely in their native tokens.

It’s a tough spot that isn’t enviable, but there are solutions. SIZE solves for this with token lock-up so diversification doesn’t mean market dumping, but liquidity. 6 – 12 month vesting options allow buyers —often VCs and MMs — to enter the ecosystem and guarantee they stay.

Cleanse the LARP

It’s never good to only point out problems without a fix. To be clear, DAOs know that there is a problem and there are thematic improvements cropping up, trends DAOs are converging on.

DAOs are adding councils because they can’t get anywhere fully democratized. There is pushback that the notion of a council is against the ethos of a DAO but the reality is that DAOs need expertise to function. A free-for-all creates stagnation and isn't beneficial to long term health of a protocol, especially when managing billions of dollars. However councils mean expertise which requires hierarchy, and is also is also very hard to discern. How do you even go about selecting a council? Who is elected, how and when? What does the council actually do?

DAOs are delegating voting power. This isn’t new. Again while helpful to hit quorum, delegating voting power can be dangerous. It increases the surface area for social engineering attacks. Who is to stop a voting whale from going rogue? Delegating leads to lazy or passive voting and to less engagement. Also, delegating voting pretty much just replicates current global political issues. DAOs are placing power in the hands of few. Isn’t this why we started DAOs?

More recently, we’ve seen DAOs hiring facilitators. This is a noble step but the reality is that it shouldn’t require pulling teeth to get people to engage. It adds an extra layer of bureaucracy while moving towards top-down governing. Who facilitates the facilitators? Who has the authority to facilitate? What do the facilitators constitute as good vs bad? Why can’t the facilitators go rogue?

So what can DAOs do? There isn’t a 0-1 solution. But there are basic steps DAOs can take to start to move the needle and improve participation, stabilize governance.

At the end of the day, each DAO is a case by case study.

Stepping back, everyone else can benefit from building their governance imaging a little, old lady. If the future of finance is really supposed to be decentralized, it needs be simple enough for a little old lady to use without sacrificing any substance.

We hope you enjoyed this blog. Please subscribe and stay tuned for more!